Navigating the Mortgage Journey

Simplifying Your Mortgage Experience

The journey to securing a home loan might seem daunting, especially if it's your first time. But fear not, our team is here to guide you every step of the way, from obtaining pre-approval to the final stages of closing. The initial step involves consulting with a mortgage specialist. If you're seeking recommendations, we're connected with some of the top lenders in the industry and would be delighted to introduce you. Rest assured, we're committed to ensuring you're well-supported throughout this crucial process.

Securing Your Loan Pre-Approval

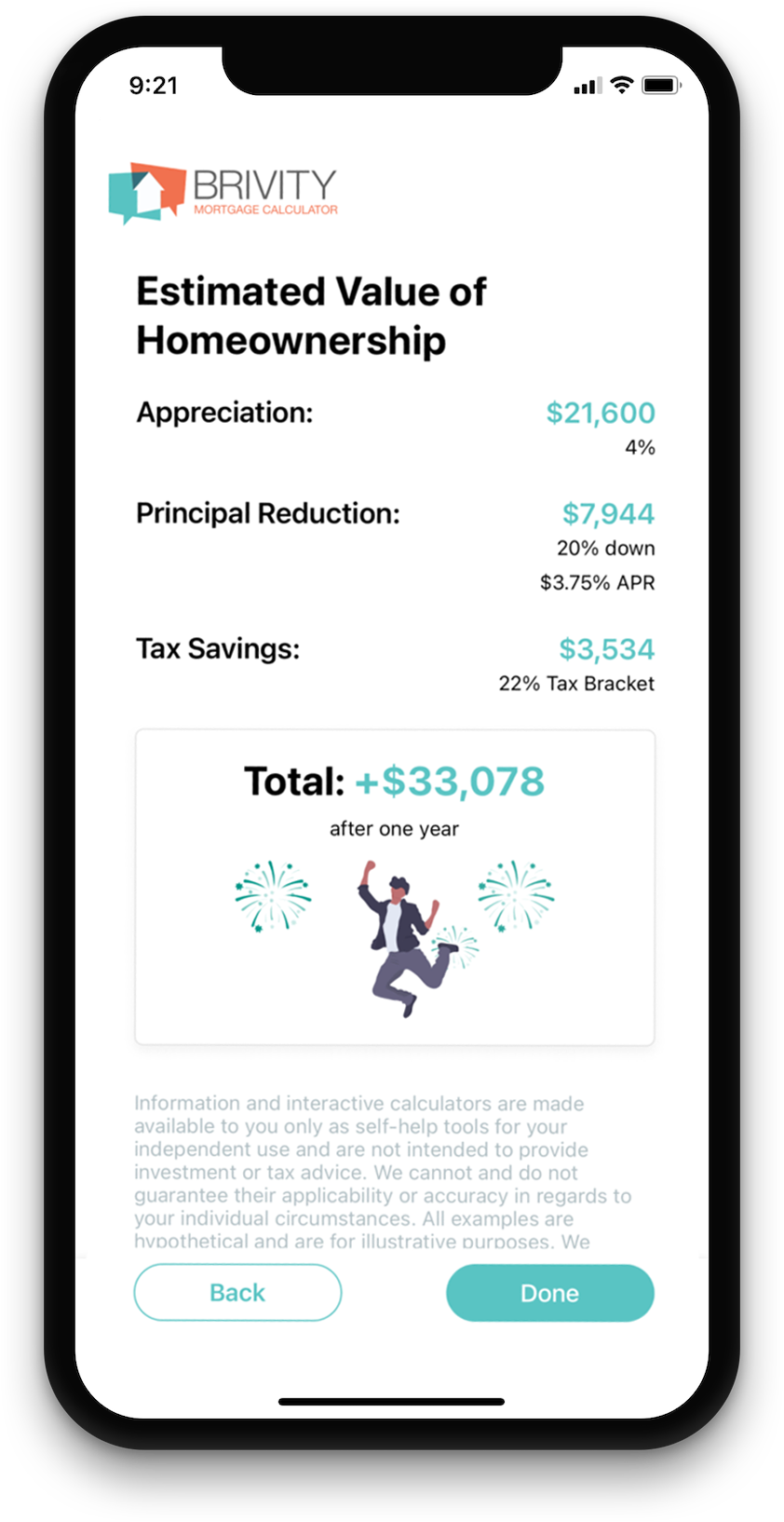

Before diving into your home search, it's wise to begin with a loan pre-approval. This step involves a detailed review by your Loan Officer of your financial status - including your income, debts, and overall financial health. They'll need documentation such as your credit report, W-2s, pay stubs, Federal Tax Returns, and recent bank statements to determine your affordable price range for a home. It's also the perfect opportunity to explore various loan options and secure pre-qualification for the programs that best fit your unique needs and preferences.

Your Ideal Loan Match

Start The Process

Our goal is to guide you to the perfect loan officer in your area, one who can offer competitive rates and tailor loan programs to suit your specific needs. Simply complete this form, and we'll swiftly connect you with a skilled lender. Start your journey towards finding the most advantageous loan option today!

Application & Processing

What happens when a loan goes "live"

As soon as you've selected a property to buy, your lender will be there to guide you through completing the full mortgage loan application. During this process, they'll explain all the fees involved and discuss the down payment options available to you. After your application is submitted, it enters the processing phase, where your documents undergo a detailed review, and orders are placed for property appraisals and title examinations. The final step involves the loan being reviewed by an underwriter, who ensures everything is in compliance and approves the loan if it meets all necessary criteria.

Closing

Signing and Finalizing the deal

It's quite common to be asked for additional details or documentation during the loan process, so don't be taken aback by these requests. Once your loan is given the thumbs up, your next step is to secure homeowners insurance. Then, your paperwork will make its way to the title company for the final act: signing to officially become the owner of your new home and settling any remaining fees. After the loan is formally recorded, the keys to your new abode are yours. Congratulations on this exciting milestone – welcome to your new home!